With Atosa, Activity and Account Statements are automatically imported into the platform – no more printing or manually typing ATO Online Services for Agents data into reconciliation workpapers

Learn more about our reconciliation reporting functionality below.

Pre-population

Pre-populated reconciliation workpapers, including customised workpapers

Atosa generates pre-populated Excel reconciliation workpapers. The part of the reconciliation that involves inputting and summarising the ATO Online Services for Agents data is already done for you!

These reconciliation workpapers can be used as standalone workpapers or copied into an existing workpaper system.

We can even customise those reconciliation workpapers for you to look and feel just like the workpapers you already use.

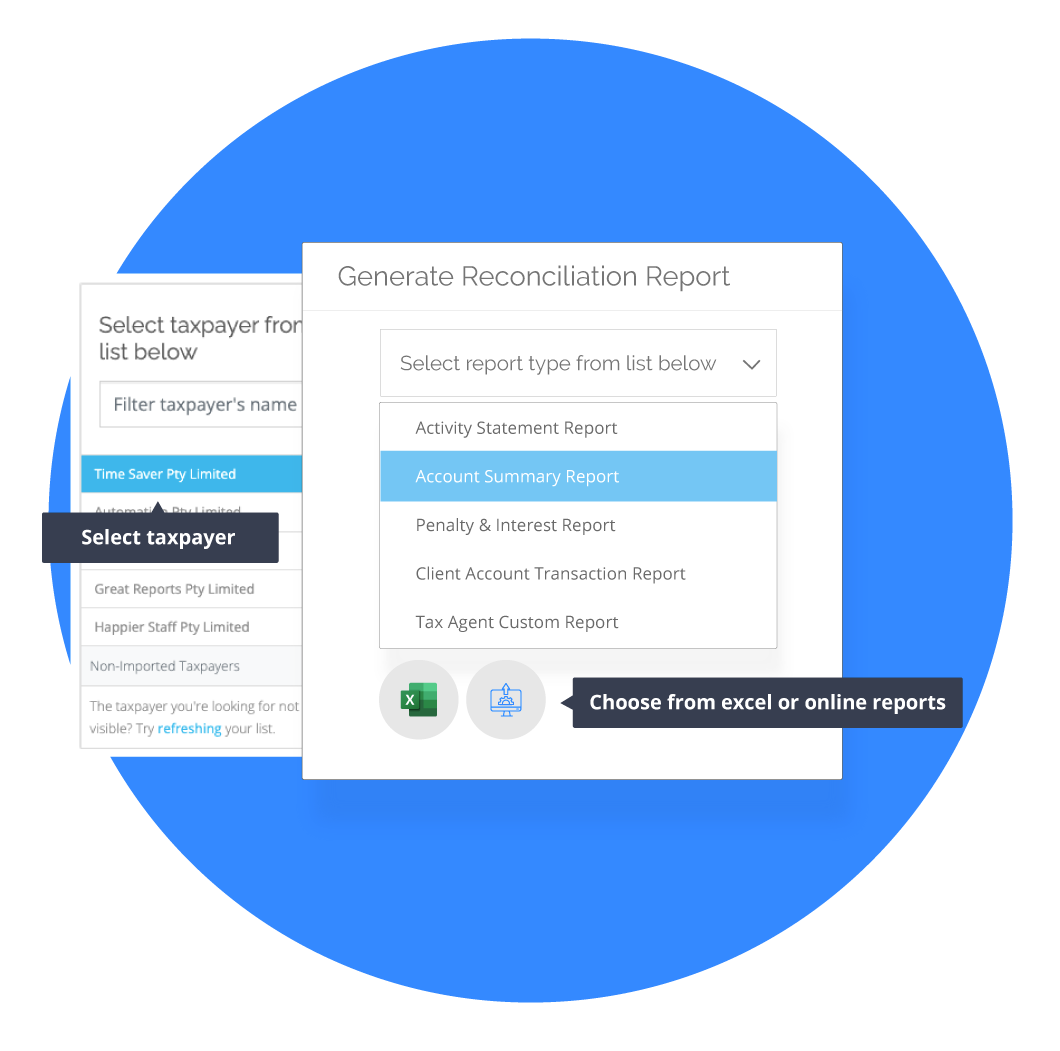

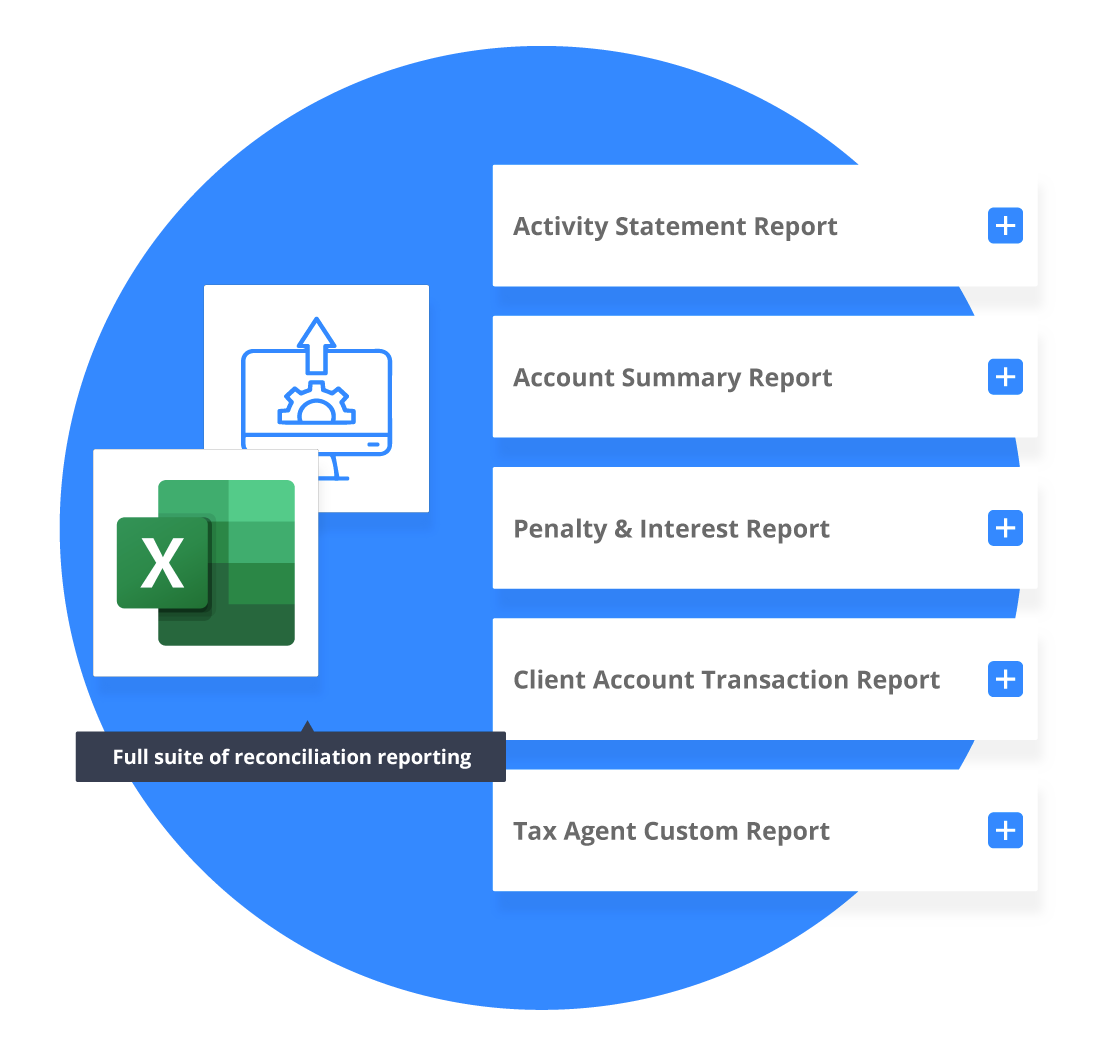

Report Types

Brilliant reports

Atosa provides brilliant reports and data analysis functionality.

Reports include an Activity Statement report, an Account Summary report and a Penalty and Interest report.

This summarises the key data from the Activity Statements, and automatically performs calculations to assist you in reconciling amounts back to the financial statements or management accounts. This includes GST reconciliations (reported GST and sales) and Wages reconciliations (reported salaries and wages and PAYG tax withheld).

This summarises the movements in taxpayer accounts (e.g. the Income Tax Account, Integrated Client Account etc) such as tax liabilities, payments, penalties, interest etc and includes opening and closing balances.

This summarises penalties, interest income and interest expense applied and remitted for any number of financial years. The report also provides a running total so you can see the cumulative effect.

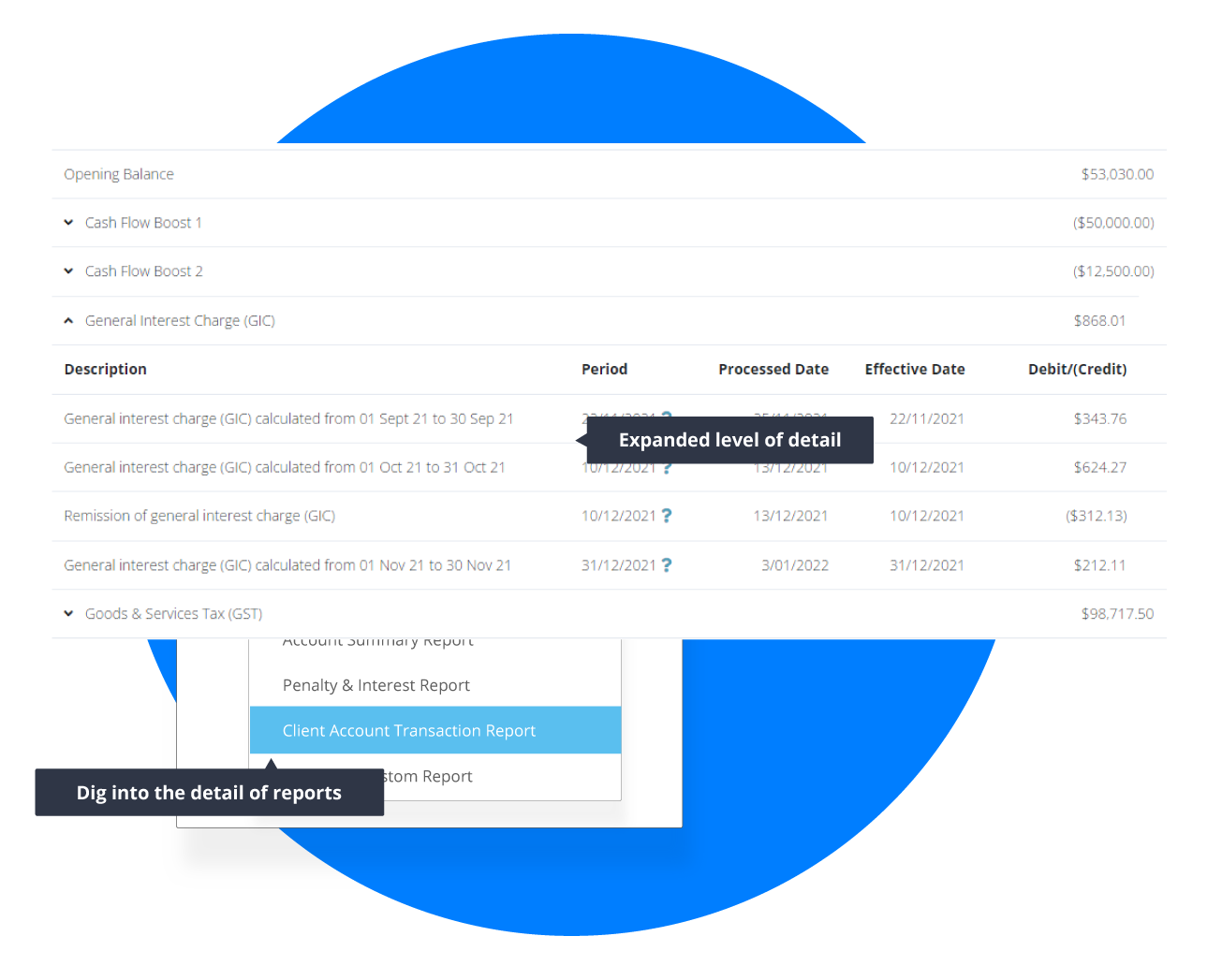

Analysis

Data analysis functionality

Data analysis functionality allows you to dig into the detail.

Visibility – You can easily identify all liabilities on an account, all payments made to an account, all interest income and interest expense on an account, all transfers in and out of an account, and so much more.

Reallocations – You can even reallocate payments to have an effective date in an earlier period. This is useful when reconciling amounts if the taxpayer’s accounts indicate the payment was made on 30 June but the ATO Online Services for Agents has processed that payment with an effective date of 1 July (throwing the liabilities as at 30 June into disarray).

Scale

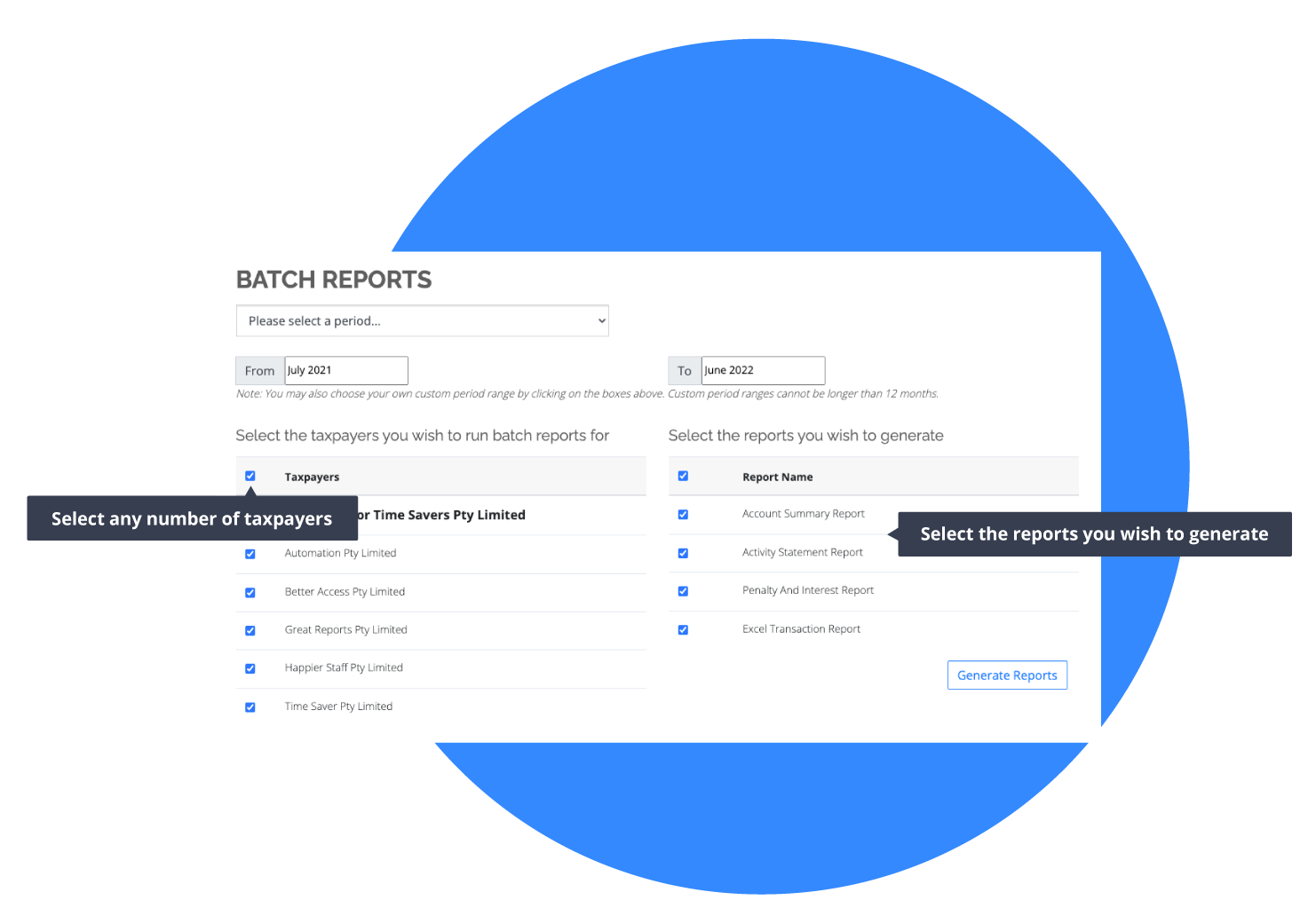

Batch Reporting

Batch Reporting quickly and easily allows you to produce Activity Statement reports, Account Summary reports and Penalty and Interest reports for a number of taxpayers at once, with those reports being exported to reconciliation workpapers.

Frequently Asked Reporting Questions

Have more reconciliation reporting questions? We’ve curated a list of our most frequently asked questions from first time users, as well as some helpful tips to get you started right away.

An Activity Statement Report summarises the Activity Statements over a given period, usually the last financial year. The Activity Statement Report provides:

- The amounts reported at each label on each Activity Statement;

- The totals of the amounts reported at each label on all Activity Statements; and

- Reconciliation workpapers which include:

- GST reconciliations (reported GST and sales to financial statements); and

- Wages reconciliations (reported salaries and wages and PAYG tax withheld to financial statements, PAYG Withholding ledgers, payroll reports and STP finalisation summaries).

An Account Summary Report summarises the movements in taxpayer accounts (e.g. the Income Tax Account, Integrated Client Account etc) over a given period, usually the last financial year. The Account Summary Report provides:

- The opening and closing balances on an accruals basis of the individual taxpayer accounts and the total of all taxpayer accounts;

- The movement in the taxpayer accounts (such as tax liabilities, payments, penalties, interest etc);

- The ability to drill down into specific taxpayer accounts to see the detail of what makes up the movement in the account on a line by line basis; and

- A reconciliation workpaper from which you can reconcile:

- the total of the opening balances;

- the total of the movements; and

- the total of the closing balances.

A Penalty & Interest Report summarises the penalties, interest income and interest expense in taxpayer accounts (e.g. the Income Tax Account, Integrated Client Account etc) over a given period, usually the last 5 financial years (including the current financial year). The Penalty & Interest Report provides:

- The net penalties, interest income and interest expense for each year, including which taxpayer accounts they relate to;

- The combined running total of the net penalties, interest income and interest expense across all taxpayer accounts; and

- A reconciliation workpaper from which you can reconcile:

- the net penalties for each financial year to financial statements;

- the net interest income for each financial year to financial statements; and

- the net interest expense for each financial year to financial statements.